SEMINOLE NEEDS CLASSES FOR TAXES

Without proper financial literacy, students struggle with basic economic concepts.

January 31, 2018

The following article was featured in our fall print issue. Print copies can be accessed in the media center or your English classroom.

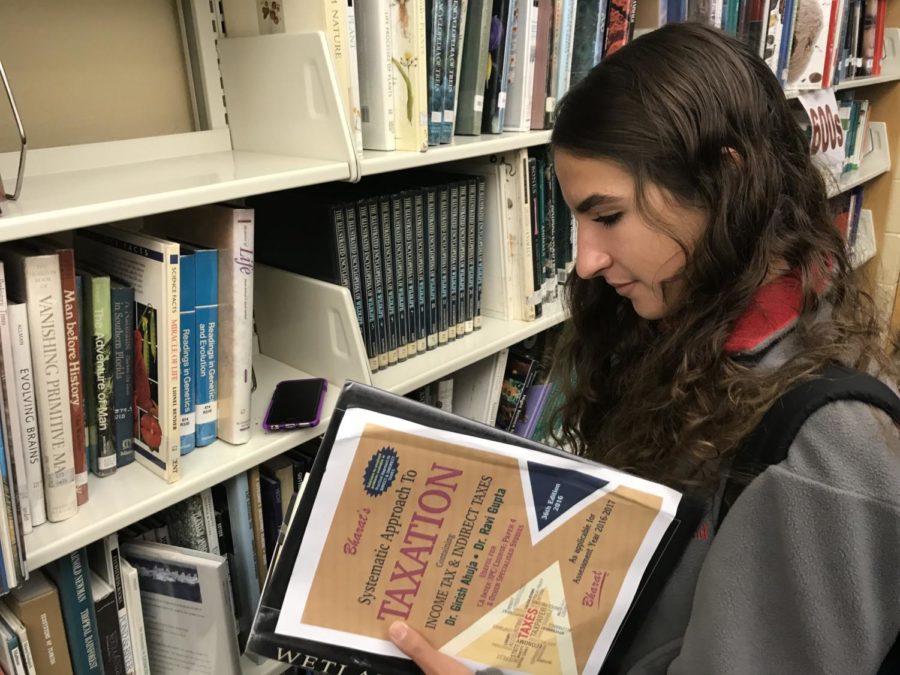

Over the years, students, especially upperclassmen, have requested a class geared toward filing and completing taxes. Students think this class would not only allow them to gain another credit on their transcript, but also provide them with information that is beneficial in their future. Although classes like economics are offered on campus, these courses only briefly go over concepts such as how to fill out taxes, payment types, and insurance information.

“I am honestly scared and unsure about my future. Yes we are learning and being educated in school so that we can have a better future, but we are not being taught about important life skills like how to file taxes,” said senior Maheen Ismail.

Numerous students believe this class should be made into an elective, which is not an unprecedented idea. Thirteen states in the U.S. require high school students to complete a personal finance class. These students can choose to either “test out,” take the course and pass upon completing, or pass the online assessment with at least a 90 percent.

However, other students see issues with making financial literacy into an elective, rather than a core class.

“I do not think it would be a good idea to make such an important class just an elective. Many students would avoid this class because it may decrease their GPA since it will be only a 4.0 class. Many students would rather it be an AP class or an honors class instead of an elective,” said senior Simran Shah.

Ultimately, the concept of finances is crucial to success, and therefore it should be stressed upon students. The lack of financial knowledge has also sparked concern among parents across the country. Students need to be educated about life skills because they cannot rely upon others forever.